On January 14, 2026, Administrative Law Judge Julie A. Fitch of the California Public Utilities Commission (CPUC) released a proposed decision requiring electric resource procurement for the 2029–2032 period. The proposal would instruct California Load Serving Entities (LSEs) to procure reliability resources with net qualifying capacity (NQC) totaling 2,000 MW by 2030 and an additional 4,000 MW by 2032.

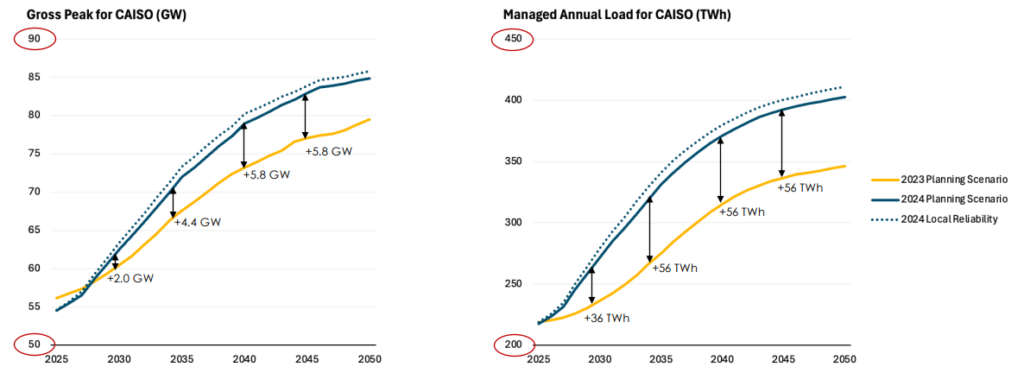

The primary rationale for this proposal is the concern that the existing supply in California is insufficient to support expected load growth. Electricity demand is forecasted to grow at an unprecedented rate in the coming years, driven primarily by data center development as well as electric vehicle charging. The California Energy Commission’s 2024 Integrated Energy Policy Report (IEPR) projects near-term peak load will exceed 60 GW by 2030, an increase of about 2 GW from the prior IEPR, and will reach nearly 85 GW by 2050.

Figure 1. Incremental increase in CAISO load forecast from 2023 IEPR to 2024 IEPR. Source: 26-27 Transmission Planning Process Report

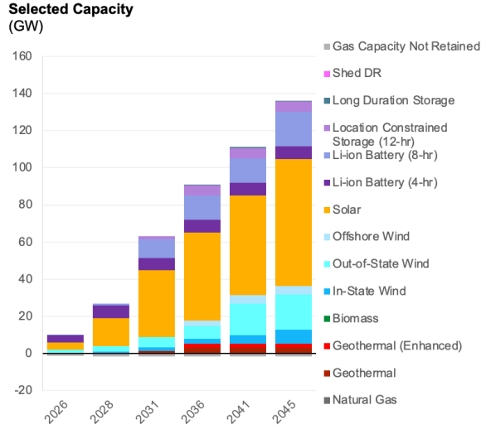

This emerging supply-demand gap was highlighted in the 2026-27 Transmission Planning Process (TPP) report, where the baseline supply portfolio included massive increases in new battery storage, solar, and wind resources to address near-term shortfalls to the planning reserve margin.

Figure 2. 26-27 TPP Proposed Base Case Supply Additions. Source: 26-27 Transmission Planning Process Report

These findings in the 2026-27 TPP were a primary driver for the CPUC’s investigation to whether an interim procurement order would be necessary. The Commission’s subsequent analysis identified the need for 6 GW of additional capacity, which forms the basis of the proposed procurement order.

Notably, the proposed order restricts the amount of storage resources to no more than half of the total capacity procured. This reflects the CPUC’s desire for resource diversity, as well as concern that, absent such limits, the majority of procurement would be met from storage alone. The implications of this restriction, if finalized, could be significant. Restriction of certain technologies may result in more expensive procurements, which will ultimately be borne by ratepayers. In place of storage, LSEs may procure more wind and solar, as well as repower capacity and potentially resources like geothermal.

Finally, as written the order has no “local” requirement, meaning resources may be located anywhere with deliverability into CAISO. This flexibility should help mitigate cost concerns by widening the pool of potential capacity resources for all LSEs. However, it also raises questions about how effectively the new capacity will address localized reliability needs, an issue that may require further analysis.

Comments from parties are due February 3, 2026, with final decision from the CPUC thereafter.

By: Devin Gaby, Associate Director Energy Advisor, Customized Energy Solutions