By: Shivam Chauhan

Lately, Canada and Germany signed a new hydrogen pact for kick-starting a transatlantic hydrogen supply chain. Pact aims to start deliveries from 2025. A signed “Declaration of intent” includes the project in Newfoundland with 164 wind turbines along the nearby Port au Port Peninsula for hydrogen production via electrolysis & ammonia production (Project yet to undergo provincial environmental approval). Additionally, Nova Scotia-based EverWind Fuels also signed MOU with Germany’s Uniper and an off-taker agreement with EON, for 500,000 tonnes of green ammonia per annum. Both targeted to start deliveries by 2025.

These recent agreements aligned with the Canada’s hydrogen strategy and its 2050 vision which is –

- To make Canada one of top 3 global clean hydrogen producers, with domestic supply >20 Mt/year.

- Establish supply base of low carbon intensity hydrogen with delivered prices of $1.50 – $3.50/kg.

- Blending hydrogen in existing pipelines with Natural Gas and setting up new dedicated hydrogen pipelines for energy usage.

- Enabling new industries by low-cost hydrogen supply network.

- Establishing competitive hydrogen export market.

Some specific areas identified for early adoption of hydrogen includes –

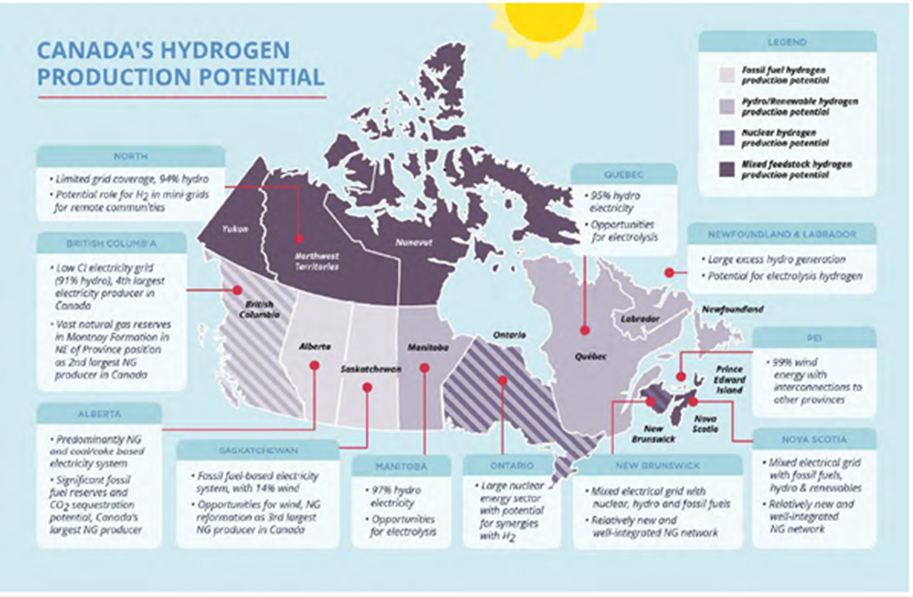

- The Alberta Industrial Heartland, near Edmonton, has several advantages to become one of the first hydrogen HUBs in Canada.

- Coastal ports in BC, Ontario, Quebec, Manitoba, and the Atlantic region are also high potential sites for hydrogen HUBs.

- The transportation corridor between Montreal and Detroit is another high potential area as it connects demand for transportation with industrial and manufacturing centres.

Some announced/existing Hydrogen projects in Canada –

- A 20MW PEM electrolyser installed in Bécancour, Quebec, by Air Liquide is now operational and currently the biggest such facility in the world (a status it is unlikely to retain even until the end of the year).

- Hydro-Québec has awarded a contract to a subsidiary of German industrial giant Thyssenkrupp to install an 88MW electrolysis plant in Varennes, Quebec, due to come on stream in 2023.

- Infrastructure bank Macquarie, gas supplier FortisBC and Renewable Hydrogen Canada are looking to develop a green hydrogen plant in British Columbia. It will use the province’s abundant wind and hydro resources to produce hydrogen that will be injected into the local gas network to reduce its carbon intensity.

- Atura Power’s Niagara Hydrogen Centre – 20 MW electrolysers at Sir Adam Back Hydroelectric Station, COD by early 2024. Hydrogen produce will be used to displace diesel engine in heavy-duty & Long-haul trucking. They are also exploring additional H2 hubs at Halton Hills energy centre and their facilities in Nanticoke, Brighton & Lambton.

- Bruce Power is exploring hydrogen production (Pink Hydrogen) from nuclear and future SMR deployments.

- Canada and Germany signed a non-binding “joint declaration of intent” to establish a green hydrogen supply corridor. Targeted to deliveries start from 2025. In Newfoundland, 164 wind turbines “Port au Port” wind project, yet to be approved, for electrolysis & ammonia production.

- Nova Scotia-based EverWind Fuels signed MOU with Germany’s Uniper to purchase green ammonia from EverWind’s initial production facility in Point Tupper, Nova Scotia. Additionally, EverWind also signs offtaker aggrement with E.ON Hydrogen, for 500,000 tonnes of green ammonia. Both targeted to start deliveries by 2025.

- Federal government and Alberta announced a $461.5 million ($300M & 161.5M respectively) investment into an Air Products Canada’s hydrogen plant in Edmonton that would use carbon-capture technology and is aiming to produce in 2024.

- Charbone Hydrogen leased a land parcel from the City of Selkirk to design, construct, and operate the first green hydrogen regional hub in Manitoba for the production and distribution facility for the supply of green hydrogen. Phase 1 of this project is targeted for commercial operations and initial deliveries as early as the fourth quarter of 2023.

- Varennes Carbon Recycling (a consortium between Shell, Suncor and Proman) plans to use renewable hydrogen and oxygen to turn non-recyclable waste into biofuels and circular chemicals in its biorefinery plant in Quebec. Facility will use 90MW PEM electrolyzer system delivered by Accelera. The facility is under construction and scheduled to be operational in 2025.

- HTEC signed an agreement with ERCO Worldwide to purchase a land in Vancouver to construct a 15-tonne per day clean hydrogen production plant. Plant is targeted to be operational by early 2026.

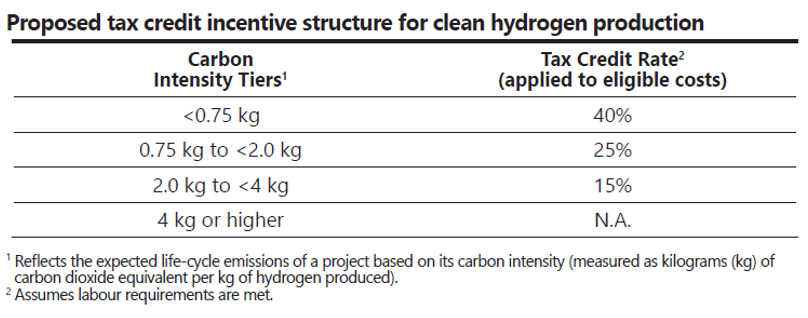

To strengthen its Hydrogen strategy, Govt. of Canada recently introduced Clean Hydrogen Investment Tax Credit in the budget 2023, that includes –

- Refundable tax credit of 15-40% of eligible project costs for:

- the projects that produce the cleanest hydrogen receiving the highest levels of support based on the below table-

- the projects that produce the cleanest hydrogen receiving the highest levels of support based on the below table-

- The Clean Hydrogen Investment Tax Credit will also extend a 15% tax credit to equipment needed to convert hydrogen into ammonia, in order to transport the hydrogen. The tax credit will only be available to the extent the ammonia production is associated with the production of clean hydrogen.

- Labour requirements, including prevailing wages and that apprenticeship minimums, will need to be met to receive the full 15-40%

- Projects not meeting these will have credit rate reduced by 10% points.

- $5.6B over 2023-2028, $12.1B over 2028-2034

On another note, which can be seen as an upward step for boosting hydrogen industry, Broker Marsh, a unit of Marsh & McLennan Cos Inc., have launched world’s first dedicated insurance for hydrogen energy projects.

Image Source: Canada’s Natural Resources Canada Department “The Hydrogen Strategy”.