By: Andreas Sakellaris, Director, Emerging Technologies and Rohit Bhide, Senior Analyst at Customized Energy Solutions

Grid-scale storage helps communities keep the lights on when vulnerable infrastructure is strained by heatwaves or knocked off-line by severe weather. According to BloombergNEF, 18 climate-related disasters caused at least $1 billion in damages last year.

The race to support the energy grid with storage is well underway and California is in the lead with 215 operational projects storing 4.2 GW. New York is also among the leading states in energy storage development — so much so that it doubled its 2030 target to 6 GW. Although only 130 MW were operating at the end of 2022 and 1.3 GW are contracted, there are up to 12 GW in the interconnection queue. Whether those projects advance depends on their business cases.

A market need and the Inflation Reduction Act have encouraged investors to develop storage projects, and NYSERDA’s Index Storage Credit (ISC) adds to the list of motivating factors with long-term revenue certainty.

The ISC is intended to support the deployment of more storage projects, which will maximize the amount of intermittent wind and solar energy that can be integrated into New York’s grid, advancing the state closer to its ambitious target of fully decarbonizing the grid by 2040.

Developers and asset owners have an opportunity to maximize revenue and create a boom in energy storage on par with Massachusetts’ Clean Peak Standard, which has helped Massachusetts become one of the top 5 states for storage assets, despite its small size. In order to capitalize on the incentives, they need to understand how the ISC works and can create revenue certainty for storage projects, improving their overall economics and their path to secure project financing.

A deeper look at the ISC

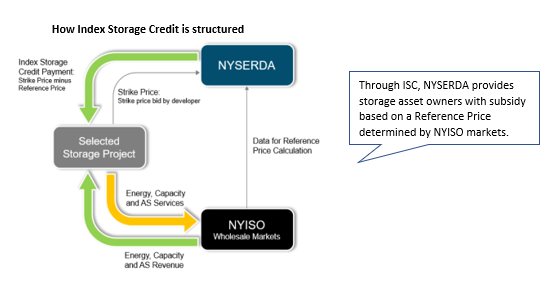

The ISC was initiated to compensate projects for infusing more energy storage in the state. Like the Indexed Renewable Energy Certificate (REC) program, developers bid a strike price in a competitive process, which represents the price awarded to the project by NYSERDA. Awarded projects are then commissioned and begin operations. NYSERDA determines a monthly reference price derived from market indices based on Reference Energy Arbitrage Price (REAP) and Reference Capacity Price (RCP) to benchmark against reasonably expected earnings. The actual revenue that the project achieves may deviate from these references, depending on how well the storage asset is operated to maximize revenue.

When the strike price is higher than the reference price, NYSERDA pays the project the difference. When the reference price is higher than the strike price, the project pays NYSERDA the difference. This mechanism incentivizes effective operations and performance so as to maximize the asset’s revenue — it needs to be charged and discharged at the right times to earn as much as possible.

Here are the parameters NYSERDA has recommended:

| ISC value | 1 ISC = 1 daily MWh of storage capacity on operational days |

| Contract term | 15 years |

| Eligible technologies | All electric, chemical, mechanical, or thermal-electric storage technologies — battery storage is likely to remain the prevailing technology |

| Storage Duration | Both four-hour and eight-hour storage systems are targeted, with greater benefit expected from longer-duration storage |

| Reference price calculation | Sum of REAP and RCP, excluding frequency regulation and other ancillary services that are difficult to calculate |

| Reference Energy Arbitrage Price (REAP) | Based on day-ahead market pricing and zonal LBMP, calculated using daily REAP as the difference between the price during the top four hours and bottom four hours of the day |

| Reference Capacity Price (RCP) | Uses NYISO installed capacity spot auctions to set the RCP, which shall vary based on location |

How ISC impacts storage asset economics

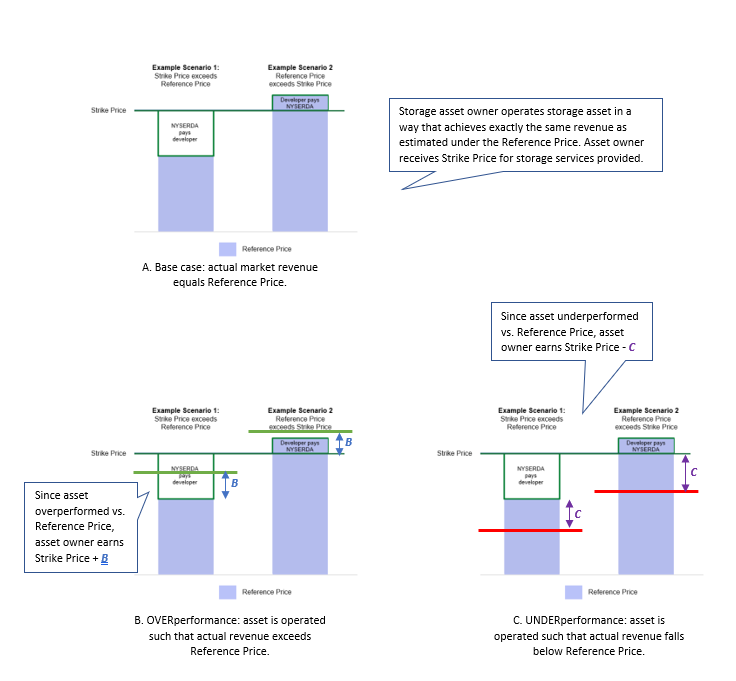

Because the reference price could be higher or lower than the actual revenue received, the project has the opportunity to overperform and is penalized if it underperforms.

For example, if the storage asset performs as expected and earns exactly the same amount as the reference price, the ISC protects the asset’s revenue whenever markets result in lower revenue than the strike price. In this base case, the project would earn the strike price because it is the same as the reference price.

If the storage asset operates very well and maximizes revenue, it will exceed the reference price, and the project benefits from having provided more valuable services to the market. This overperformance results in the project earning the strike price and NYSERDA paying the difference between the strike and reference prices.

And if the storage asset operates poorly and its revenue is below the reference price, the project is penalized for having provided poorer-than-expected services to the market. In this case, it earns the strike price minus the difference.

The actual impact of the ISC on storage asset economics will depend on how effectively the mechanism is implemented and how its parameters are calculated. If the ISC is implemented as indicated by NYSERDA, it will provide downside protection to storage asset owners, ensuring a minimum revenue whenever market conditions for storage are adverse.

This is crucial for storage assets to be able to secure financing – akin to how a power purchase agreement (PPA) ensures revenue stability for renewable energy (RE) assets and helps them secure project financing. Considering the ISC’s incentives to create new storage asset projects, developers could enjoy a surge of opportunity and benefit communities across New York by providing relief for a burdened energy grid.

About Customized Energy Solutions (CES)

Established in 1998, Customized Energy Solutions is an energy advisory, software and services company that works closely with clients to navigate the wholesale and retail electricity markets across the United States and globally. CES offers software solutions, back office operational support, and advisory and consulting services focused on asset optimization and energy market participation efficiency. CES is also a third-party asset manager of more than 20,000 MWs of renewable and conventional generation resources across all ISOs in the United States, Ontario, Canada and Guam. CES empowers clients to achieve their goals by helping them navigate the evolving energy markets, complex market rules, and new energy technologies. To learn more, visit CES-LTD.com or connect with CES on LinkedIn, Twitter, and Facebook.

Media Contacts

Anila Vangjeli

Marketing Manager, Customized Energy Solutions

avangjeli@ces-ltd.com

267-507-2134

Diagrams Source: New York State of Opportunity – Public Service Commission